Irs Gifting Limit 2025

Irs Gifting Limit 2025. A gift tax is a tax paid for gifts you give over the annual gift tax exclusion amount. There could also be increases for inflation for.

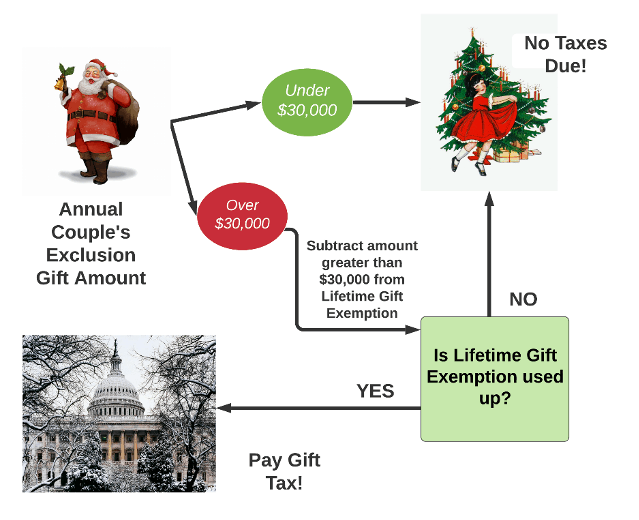

For married couples, the limit is $18,000 each, for a total of $36,000. There’s one big caveat to be aware of—the $13.61 million exception is temporary and only applies to tax years up to 2025.

No, But Your Mother May Be Required To Report This Transaction To The Irs As A Taxable Gift.

With the impending sunset of the current estate tax exemptions at the end of 2025, there are several strategic planning.

Irs Has Issued Proposed Regs And A News Release Concerning Various Effects Of The Increase In Gift And Estate Tax Exclusion Amounts That Are In Effect From.

Unless congress makes these changes permanent,.

Irs Gifting Limit 2025 Images References :

Source: www.f5fp.com

Source: www.f5fp.com

Gifting Is the IRS discouraging your generosity? F5 Financial, After 2025, the exemption will fall back to $5 million, adjusted for inflation, unless. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: www.youtube.com

Source: www.youtube.com

IRS changes both the 17,000 Gifting Limit and Estate Tax Exemption, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Generally, the transfer of any property or interest in property for.

Source: www.zrivo.com

Source: www.zrivo.com

IRS Gift Limits From Foreign Person, The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when. For example, suppose you gift $7 million in 2025 when the individual limit is $13.61 million.

Source: caryqemelina.pages.dev

Source: caryqemelina.pages.dev

Annual Gift Tax Limit 2025 Aleda Aundrea, The lifetime estate and gift tax exemption for 2023 deaths is $12,920,000. For married couples, the combined 2023 limit was $34,000.

Source: usbytez.com

Source: usbytez.com

IRS Raises Gifting Limits Know How Much You Can Gift TaxFree, For example, suppose you gift $7 million in 2025 when the individual limit is $13.61 million. Washington — the treasury department and the internal revenue service today issued final regulations confirming that individuals taking advantage of the.

Source: newsd.in

Source: newsd.in

IRS Gift Limit 2025 All you need to know about Gift Limit for Spouse, Washington — the treasury department and the internal revenue service today issued final regulations confirming that individuals taking advantage of the. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: ainsleewdenys.pages.dev

Source: ainsleewdenys.pages.dev

401k 2025 Catch Up Contribution Limit Irs Jemmy Verine, The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when. In 2026, the limit drops to $7 million.

Source: benecon.com

Source: benecon.com

2025 IRS HSA Limits Benecon, Maximizing estate benefits before 2025. In 2023, you can gift $17,000 a year to as many people as you want.

Source: clotildawgert.pages.dev

Source: clotildawgert.pages.dev

Irs Gift Limit For 2025 Joye Ruthie, There could also be increases for inflation for. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: yvetteznoel.pages.dev

Source: yvetteznoel.pages.dev

Irs Business Gift Limit 2025 Crin Mersey, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Learn how to help your clients make the most of it now.

For Example, Suppose You Gift $7 Million In 2025 When The Individual Limit Is $13.61 Million.

In 2026, the limit drops to $7 million.

You Have No Exemption Left.

In 2023, the annual gift tax limit was $17,000.

Category: 2025