Maximum Health Care Fsa Contribution 2025

Maximum Health Care Fsa Contribution 2025

Here, a primer on how fsas work. You must use your fsa contributions before an annual deadline or risk forfeiting your money.

Employees can now contribute $150 more. Fsas only have one limit for individual and family health.

Employees Participating In An Fsa Can Contribute Up To $3,200 During The 2025 Plan Year, Reflecting A $150 Increase Over The 2023 Limits.

It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside.

What You Need To Know.

This is a $150 increase from the 2023.

Images References :

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

Federal Hsa Limits 2025 Renie Delcine, You must use your fsa contributions before an annual deadline or risk forfeiting your money. The 2025 health fsa limits increase contribution amounts for employee benefit plans.

Source: integritytaxsoftware.com

Source: integritytaxsoftware.com

Maximize Your Healthcare Savings in 2025 The Updated FSA Contribution, That's a $150 increase from 2023. The irs has increased the flexible spending account (fsa) contribution.

Source: www.myfederalretirement.com

Source: www.myfederalretirement.com

Health Care FSAFEDS Contribution Limits Increase for 2025, The health savings account (hsa) contribution limits increased from 2023 to 2025. Employees can now contribute $150 more.

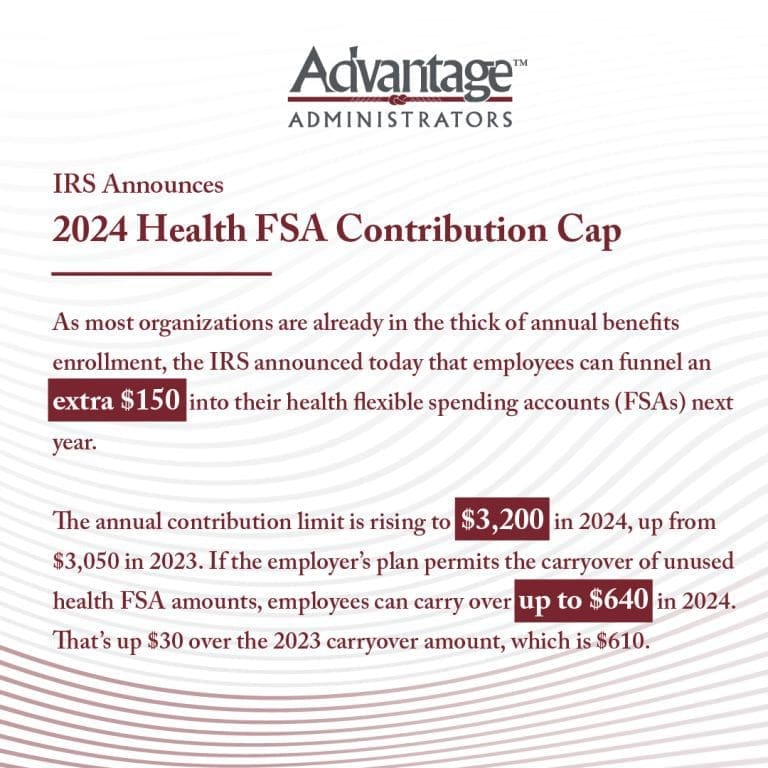

Source: advantageadmin.com

Source: advantageadmin.com

The IRS Just Announced the 2025 Health FSA Contribution Cap!, For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions. This is unchanged from 2023.

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2025 Nissa Leland, The hsa contribution limit for 2025 is $4,150 for individual coverage and $8,300 for family coverage. This is unchanged from 2023.

Source: lanaqrobina.pages.dev

Source: lanaqrobina.pages.dev

Maximum Defined Contribution 2025 Sandy Cornelia, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2023 limits.

Source: lawdailylife.com

Source: lawdailylife.com

2025 HSA and FSA Contribution Limits Maximize Your Healthcare Savings, For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to. That's a $150 increase from 2023.

Source: costanzawwilow.pages.dev

Source: costanzawwilow.pages.dev

Fsa 2025 Eligible Expenses Bella Carroll, This is unchanged from 2023. The irs has increased the flexible spending account (fsa) contribution.

Source: ardenqkiersten.pages.dev

Source: ardenqkiersten.pages.dev

Fsa Approved List 2025 jaine ashleigh, The hsa contribution limit for 2025 is $4,150 for individual coverage and $8,300 for family coverage. You must use your fsa contributions before an annual deadline or risk forfeiting your money.

Source: imagetou.com

Source: imagetou.com

Hsa Contribution Limits For 2023 And 2025 Image to u, The new limit means married couples can jointly contribute up to $6,400 for their household. As health plan sponsors navigate the open enrollment season, it’s.

It’s Open Enrollment Season For Many Organizations And Knowing The Updated Fsa Limits Will Help Individuals Better Plan Amounts To Set Aside.

For health fsa plans that permit the.

This Is Unchanged From 2023.

For example, if you contribute $2,000 for 2025,.